How To Help Insurance In Natural Disasters?

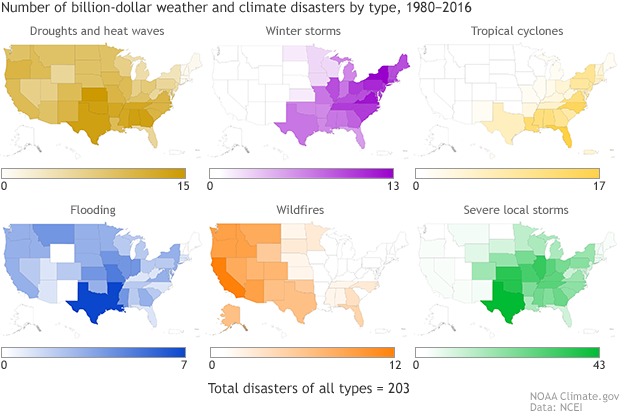

When natural disaster strikes, generally the magnitude of the disaster makes it troublesome to understand the devastation it visits on a personal house owner or renter. nobody needs to awaken the morning once a disaster to seek out all their property destroyed and while not insurance to guard and replace their assets. in the short term, getting insurance against natural disasters will be an awfully simple factor to place off, and it appears like a homeowner’s policy ought to cowl against natural disasters anyway. whereas that’s true of wildfires and tornadoes (at least with most policies within the U.S.), harm from earthquakes, landslides, and floods isn't lined. If you reside in a neighborhood that’s at high risk for any of them on top of disasters, getting flood or earthquake insurance is crucial.

1. Getting the Most from Your Homeowner's Insurance Coverage

1.A. Know what is lined. Most U.S. homeowner's insurance policies cowl 2 kinds of natural disasters--wildfires and tornadoes. Hurricanes are harder to categorize; the harm from wind and rain throughout a cyclone is typically lined, however, flooding isn't.

For example, if the wind from a cyclone skint your windows and also the rain has broken your floor, each of these kinds of harm would be lined. If the rain overladen the storm drains in your neighborhood and resulted in an exceeding flood, that might not be lined.

For example, if the wind from a cyclone skint your windows and also the rain has broken your floor, each of these kinds of harm would be lined. If the rain overladen the storm drains in your neighborhood and resulted in an exceeding flood, that might not be lined.

1.B. Opt for replacement worth. whereas insurance is meant to safeguard you against loss, not each policy values reimbursements equally. There area unit some alternative ways associate degree insurance underwriter can worth your items: actual money worth, replacement worth, and extended replacement worth.

- Actual money worth reimburses the owner for this money worth of the item. this can be typically the stingiest methodology of compensation, as a result of most things depreciate in worth instead of appreciating. thus if your 5-year previous pad was destroyed in an exceedingly fireplace, the nondepository financial institution will not reimburse for what it prices to travel notice a replacement pad, except for the worth of a 5-year previous pad.

- Replacement worth does not think about depreciation, meaning it is an additional generous methodology of compensation.

- Extended replacement worth could be a methodology of compensation that reimburses for the value of replacement and an additional share.

1.C. Try to keep your premiums low. There I a variety of the way to stay your premiums low that does not involve raising your deductible. These embody putting in safety devices, bundling, and retrofitting your home.

- Safety devices that may lead to massive savings embrace smoke detectors, mechanical device systems, and fireplace extinguishers.

- Bundling insurance suggests that carrying multiple varieties of insurance with one carrier. you'll be able to sometimes get a reduction a lot of policies you carry at a time.

- Retrofits that may lower a premium embrace exchange single pane glass windows with double pane glass, and fireplace resistant roofing materials, like metal roofing.

2. Getting Flood Insurance

2.A. Go to the National Flood Insurance Program’s website. settled at http://www.claimnationusa.com/, the National Flood Insurance Program is that the place to begin your explore for flood insurance within the U.S. There you'll find out about flood insurance generally, confirm the danger of flooding in your space, and even notice native agents UN agency sell flood insurance.

2.B. Determine the amount of risk in your space. you'll be able to determine what the danger profile for your property is true on the homepage of floodsmart.gov. All you've got to try to is enter your address—it can tell you the amount of risk for your address and your annual premium.

- If you live in a high-risk area, it means there’s at least a 25% chance of a flood occurring during the lifetime of a thirty-year mortgage. If you live in a high-risk area and have a federally-backed mortgage, flood insurance is mandatory.

- Although mortgagors in lower risk areas are not required to purchase flood insurance, flood damage from those areas represents over 20% of all claims and 30% of all disaster assistance.

- If you would like to view a map of the flood risk in your area, go to https://msc.fema.gov/ portal and enter your address.

2.C. Make sure you recognize what’s lined. There square measure 2 basic kinds of flood insurance, structural insurance and contents insurance. Structures square measure insured up to $250,000 and contents square measure insured up to $100,000.

- Structural insurance covers the actual home itself, including the foundation, walls, roof, heavy appliances, flooring, electrical and plumbing systems, and HVAC systems.

- Contents insurance covers what is inside the home, such as your personal belongings, washers and dryers, artwork up to $2,500, window AC units, dishwashers, and microwaves.

2.D. Pick an inexpensive deductible. the quality deductible for flood insurance is $500 for brand spanking new homes and $1,000 for older homes. That deductible applies singly to the coverage on the structure and therefore the coverage of the contents of the house. you'll be able to decide the next deductible (up to $5,000) in an endeavor to lower your monthly payment. keep in mind tho', the next deductible isn’t very saving you cash within the sense of you obtaining additional for paying less. All the upper deductible will is obligate you to pay additional out of pocket once disaster strikes.

- If you’re tempted to opt for a larger deductible, think long and hard about it. The average flood insurance claim is $30,000, and in the event of a major disaster, can be much higher. A major flood might destroy your home, but it can also devastate your entire region. If you’re out of work and your bank has been destroyed right along with your home, paying the extra $4,500 might be much more difficult than it sounds.

- Making adjustments to the deductible is the primary way people influence their monthly flood insurance payments. Premiums are otherwise determined by the National Flood Insurance Program; the insurance carriers don’t influence the price one way or the other.

2.E. Retrofit your home. There are many renovations you'll create to assist flood-proof your home, and most of them can lower your premium. a number of these is quite pricey, in order that they may not get themselves for many years. all the same, you may notice it’s worthwhile to travel ahead and obtain the renovations. they're going to prevent from injury, and not having to travel through the trouble of repairing injury is its own reward.

- Some of these renovations include elevating your home, elevating your furnace or your AC unit, moving outlets higher up on the walls, and moving your circuit breaker to a higher floor.

- If you do elevate your home, make sure to get the elevation certified. Elevation certificates can be purchased from architects or land surveyors in your area. To find a surveyor, go to the website of your state association of surveyors and find one in your area.

2.F. Speak with Associate in Nursing agent. The National Flood Insurance program incorporates a directory of agents commerce flood insurance in your space. so as to buy a policy, merely head to https://www.floodsmart.gov/floodsmart/pages/residential_coverage/agent_locator.jsp and enter your address, then speak with Associate in Nursing agent close to you.

2.G. Consider excess flood insurance. Flood insurance beyond what’s available through the National Flood Insurance Program is both pricey and hard to come by (imagine a premium of $12,000 per year for 2.5 million in coverage). However, it is available for purchase on the private market from select insurers. Some of the larger insurers offering excess flood insurance coverage include AIG, Fireman’s Fund, and Lloyd’s of London.

3. Getting Earthquake Insurance

3.A. Find a career. Before you'll prefer a policy, you’ll get to notice associate insurance carrier. this is often best on the West Coast. In American state, wherever the danger of earthquake is greatest, earthquake insurance is oversubscribed by the American state Earthquake Authority (CEA). additionally, GeoVera and point sell earthquake insurance to residents on the complete sea-coast.

- If you don’t live on the West Coast, ask your home insurer about earthquake insurance. Most of the larger carriers will offer it, and those that don’t will be able to point you in the right direction.

3.B. Make sure you recognize however coverage is itemized and what's lined. In most policies, totally different limits area unit applied to non-public property coverage, living expenses, and coverage for structural harm. folks usually try and save cash by skimping on private property coverage, that starts out at concerning $5,000. solely you recognize what quantity your property is price, however, make certain you aren’t considerably under-insuring yourself.

- Watch out for items like stock certificates, cash, and art. Most policies limit the coverage of collectibles and don’t cover high ticket items like crystal and China at all. Keep items like stock certificates, cash, and other paper valuables locked in a secure place, such as a safety deposit box.

- Additional living expenses (ALE) covers temporary expenses like hotel rooms you might have if an earthquake rendered your home unlivable. Basic plans start out with just $1,500 worth of ALE coverage, but it can go as high as $25,000

- If you live on an elevation or at the bottom of a hill, make sure that landslides are covered in the policy.

- You may also want to buy separate loss coverage insurance specifically for specialty items such as exotic cars or certain pieces of valuable art.

3.C. Choose an affordable deductible. The chances of your home being destroyed in an earthquake are small. Still, the damage caused by earthquakes is often severe. Because of the severity and expense of the damages, premiums for earthquake insurance are high—as high as the premium for homeowner’s insurance. In order to save money, a lot of homeowners keep the premiums low by agreeing to a high deductible.

- This can be risky. Instead of a number, the deductible for earthquake insurance is a percentage of the home’s value. So a 20% deductible for a $500,000 house would amount to $100,000. Most people won’t be able to produce $100,000 on demand. Can you?

3.D. Check into discounts for retrofitting your home. Since the risk of an earthquake and the level of damage from a quake is mostly out of a homeowner’s hands, it’s not easy to get a discount on earthquake insurance. That’s because a risk is calculated based on the location, size, and age of your home, as well as the type of soil it sits on and its proximity to fault lines. However, you can try to make your home more earthquake resistant, which can bring down premiums.

- Even though these bring down premiums, the discount might not pay for itself right away.

- Earthquake proofing your home would include upgrades like bolting the framing to the foundation, bracing the walls with plywood, and attaching the hot water heater to the studs in the wall.

4. Comparing Insurers

4.A. Check out their financial stability. Unlike deposits in a bank, the premiums you pay to an insurer aren’t guaranteed by any federal agency. If an insurer fails, you lose your money. While it isn’t likely a house fire would be the event causing an insurer to go bankrupt, a natural disaster can bankrupt an insurer on shaky financial footing. Therefore, it’s critically important that you investigate the financial stability of an insurer before you purchase a policy.

- You can find the financial strength of an insurer through one of the financial rating firms. The strength of a firm is evaluated on a scale of AAA to D, with AAA being the best and D the worst. Some of the more well-known financial rating services include Moody’s, Standard and Poor’s, and Fitch IBCA.

4.B. Ask the state insurance commissioner about their history. U.S. state insurance commissioners will have records of complaints, licenses, and whether or not the insurer is covered by the state in case of default.

- Some state insurance commissions also keep records of the insurer’s loss ratio. The loss ratio describes the proportion of premiums spent in payouts. Anything less than 50% of payouts is suspicious—the insurer either overcharges or underpays.

4.C. See if you can get any discounts. It never hurts to ask if you can get a discount on the premium price. While adjusting deductibles and making modifications to your house is likely to be the principle ways to receive a discount, there are a couple other ways to get your rates down.

If you use the same insurer for multiple policies, like auto, homeowner’s and others, you’ll likely be eligible for a discounted rate. You can also ask the insurer if they issue discount to your employer.

Comments

Post a Comment